30 years ago our western/developed economies were experiencing higher inflation and growth than today. The inflation was tamed by a combination of higher interest rates and some slowing in government deficit spending. As inflation reduced, nominal interest rates fell, but real (inflation adjusted) interest rates did not reduce anywhere near as quickly.

Over the past 30 years long term interest rates have fallen from ~12% pa to ~1 pa. So asset values have effectively had a boost in the price to earnings multiple from 8.5 times to 100 times if we simply use the inverse of the long term bond rate, However equities, being volatile and prone to occasional crashes, command a premium over bonds to attract purchasers, so let's make the growth in PE multiples from 10 times to 33 times.

This fall in interest rates has also reflected slowing of real growth rates on a per capita basis in most developed countries. Nominal GDP has grown through the effects of immigration, inflation and productivity.

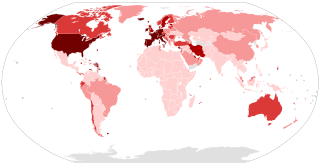

These falls in interest rates did not of themselves cause major realignments of currencies, because the governments of other western countries were doing the same things. While the currencies were generally losing purchasing power (generally measured in relation to a basket of consumption goods) at similar rates the relative values of the currencies tended to relatively remain stable, except for other reasons eg Australia and it's post GFC resources development boom.

These interest rates were driven by giving central banks an appearance of independence and a mandate which typically includes goals of maintaining full employment and keeping the value of the currency reasonably stable over time at a target rate of inflation (loss of consumer purchasing power).

In fact, central banks are not wholly independent of governments as the central bank must respond to the impact on the economy of the change in spending by governments. If governments spend too much inflation breaks out and central banks raise interest rates and if governments don't spend enough the private sector loses spending power and the central bank cuts interest rates to increase spending power of most businesses and consumers (but reduces the spending power of those dependent on interest income, which is typically older retired people).

The relatively consistent increase in asset values brought about by falling interest rates over a long period creates a golden era for governments, democratic and autocratic, because everyone is happy to see the value of their assets going up, whether it be their home, retirement savings, share market investments or investment properties. The increase in value of housing also provides a way to assist funding of retirements as retired people sell large homes in prime locations for employment and buy smaller homes, sometimes in less expensive areas where there are reduced opportunities for employment. The reduced employment opportunities do not affect retired "empty nesters".

So, given that background, what is the outlook for long term interest rates over the next 30 years?

Well, to achieve the same outcome of a golden glow of happiness in the population, why wouldn't governments continue with the same approach?

So expect to see one of three things:

1. interest rates keep falling through the 0 mark and moving increasingly negative over the long term

2. increased deficit spending by governments to maintain full employment or

3. some combination of the above.

3. some combination of the above.

At present progressive governments tend to spend more to increase employment and conservative governments restrict spending to maintain a pool of unemployed to give employers more bargaining power and thereby force central banks to cut interest rates. This is often done under the guise of "stopping the blowout in government debt"

Japan has tended to increase deficit spending rather than reduce interest rates substantially below the 0 mark, especially at extreme times such as during a recession. Lowering interest rates does not send as powerful a signal that the economy and jobs will be protected as government showering money on the private sector. When governments are practicing what they call "fiscal responsibility" and the economy is slowing, cuts in interest rates are often sufficient to increase spending, but not when there is a severe economic or social disruption.

So over the next 30 years, I expect interest rates to continue to fall when conservatives are in power and will not be surprised to see the 0 bound breached more and more frequently until we enter a period of stained negative interest rates, even if immigration is able to be resumed Covid-19. When progressive governments are in power we will see expanded deficit spending and higher so called "government debt" (although much of it will be held by central banks and so be fake debt owed by one part of the government to another part of the government). Over the long period we will see the effect of alternating policies as we have seen over the 30 years.

Japan has tended to increase deficit spending rather than reduce interest rates substantially below the 0 mark, especially at extreme times such as during a recession. Lowering interest rates does not send as powerful a signal that the economy and jobs will be protected as government showering money on the private sector. When governments are practicing what they call "fiscal responsibility" and the economy is slowing, cuts in interest rates are often sufficient to increase spending, but not when there is a severe economic or social disruption.

So over the next 30 years, I expect interest rates to continue to fall when conservatives are in power and will not be surprised to see the 0 bound breached more and more frequently until we enter a period of stained negative interest rates, even if immigration is able to be resumed Covid-19. When progressive governments are in power we will see expanded deficit spending and higher so called "government debt" (although much of it will be held by central banks and so be fake debt owed by one part of the government to another part of the government). Over the long period we will see the effect of alternating policies as we have seen over the 30 years.

It is possible that in 10 years we could see long term bond rates at -5% pa, bank deposit rates at -6% pa, home loan rates at -4% pa, and for house prices and stock prices to have continued increasing at 5% pa and so producing capital gains for investors even from today's seemingly bubble prices.